Weekly I/O: How to systematically change behavior, We put man on the moon before wheels under luggage, Treat your career as a portfolio

#73: Fogg Behavior Model, Wheeled Suitcase Paradox, Career as Portfolio, Love Ones Makes Us Laugh, Opinions Afraid to Share

Hi friends,

Greetings from Mountain View!

Here's your weekly dose of I/O. I hope you enjoy it!

Input

Here's a list of what I'm exploring and pondering on this week.

1. Fogg Behavior Model: Behavior = Motivation x Ability x Prompt. Three elements must converge at the same moment for a behavior to occur.

Article: Behavior Model

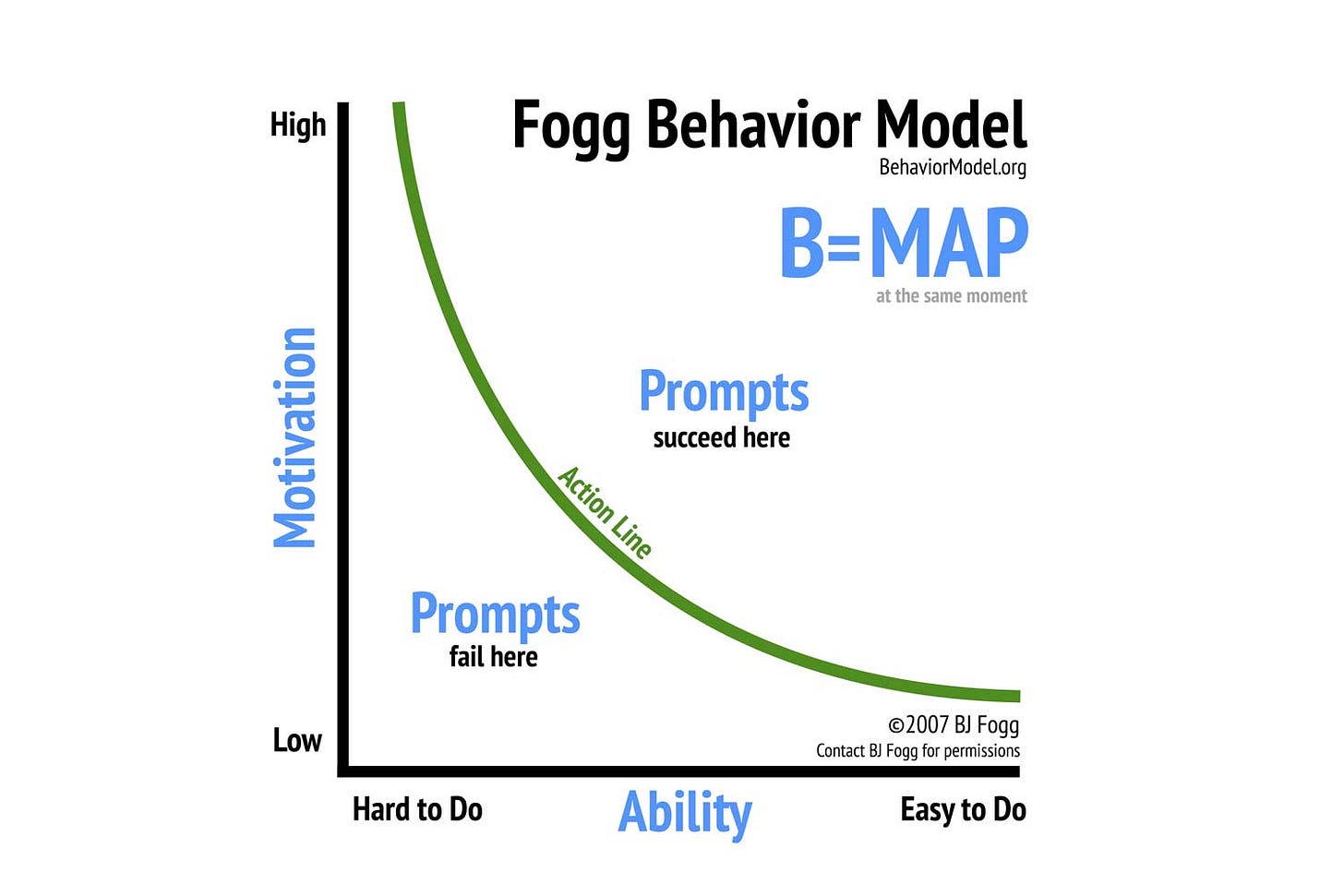

Fogg Behavior Model is a framework for understanding systematically how behavior change happens. According to the model, three factors must converge simultaneously for a behavior to occur: Motivation, Ability, and Prompt.

Motivation drives people to do challenging things. When motivation drops, we fall back on doing easy things. There are three core motivators: Sensation (pleasure/pain on physical level), Anticipation (hope/fear on emotional level), and Belonging (acceptance/rejection on social level).

Ability refers to how easy it is for someone to perform a specific task at a given time. Ability is not just skill but also the simplicity of the task. The simpler the behavior, the more likely it will happen.

Simplicity depends on your most limited resources at the moment, such as time, money, physical effort, mental effort, or routine. The most limited factor becomes the bottleneck that makes the behavior challenging. For example, when people are running out of time, time is the bottleneck preventing the behavior from occurring.

Prompts is the cue that triggers the behavior. Even with high motivation and ability, a behavior won't happen without a prompt. Prompts come in three forms: Facilitators (increase Ability), Sparks (boost Motivation), and Signals (provide a clear action step for those with both Ability and Motivation).

The curved line on the model also shows that Ability and Motivation have a compensatory relationship, meaning when one is low, the other must be high for behavior to happen.

In terms of changing human behavior, this also reminds me of Three Ways to Change.

2. It took nearly 6,000 years to progress from inventing the wheel to the creation of the wheeled suitcase. Humans put a man on the moon before adding wheels to luggage.

Book: Antifragile

The first patent of wheeled suitcase was registered in 1970 by Bernard Sadow, meaning Neil Armstrong carried his luggage by hand on his way to the moon.

It took nearly 6,000 years to progress from inventing the wheel to creating the wheeled suitcase. For years, travelers unnecessarily exerted themselves by carrying luggage manually, potentially harming their health. Yet, wheeled luggage came into existence three decades after the moon landing, despite the available technology.

Taleb proposed a practical heuristic: "The simpler and more obvious the discovery, the less equipped we are to figure it out by complicated methods." Simplicity is often overlooked in innovation as the focus is often on complex and newsworthy ideas. Effective solutions are often simple and revealed through practical application rather than complex theories. Therefore, Taleb asks:

"How many of these simple, trivially simple heuristics are currently looking and laughing at us?"

3. Treat your career as a portfolio of jobs, roles, and opportunities. Assess new opportunities in the context of your lifetime career portfolio, not just on individual risk or reward.

Professional money managers don't think about individual investments in isolation. Instead, they see investments as part of the portfolio. Each investment has its own risks and potential returns. Some investments may be riskier, but what matters is how they all balance out in the portfolio.

Marc Andreessen believes we should look at our career as a portfolio of various jobs, roles, and opportunities, each with individual risk and potential return. Risk can be job instability, geographic constraints, or the opportunity cost of not pursuing other options. Potential returns can be skill development, valuable experiences, networking opportunities, or income.

Treating your career as a portfolio enables long-term, strategic planning over its likely 50+ year span. In an early career, fresh out of school, you may lean towards riskier roles with higher returns in skill development, experience, and connection. This might change when you have a family, shifting towards more stable and secure roles. As your life circumstances change again, your portfolio can adapt to include roles that offer a different balance of risk and reward.

Therefore, when an opportunity pops up, we should not evaluate it as a standalone prospect, pondering whether this opportunity is too risky or too secure. Instead, we should assess how each opportunity fits strategically within the broader context of a lifetime career portfolio.

While Marc’s idea of viewing your career as a portfolio is useful, it is crucial to note a key difference between the two. Careers are sequential, where one role can directly affect future opportunities, meaning they are often interconnected. On the other hand, investments in a portfolio are usually aimed to have a low or even negative correlation to reduce risk. In other words, they operate in parallel and are generally not related.

4. “Among those whom I like or admire, I can find no common denominator. But among those whom I love, I can. All of them make me laugh.” — W. H. Auden

Quote

I found this quote from W. H. Auden beautiful. It reminds me of the quote from Maya Angelou: "People may forget what you said, people may forget what you did, but people will never forget how you made them feel.".

5. Do you hold opinions you're afraid to share with peers? If not, maybe you just believe what you're told rather than think independently.

Book: Hackers & Painters

From Paul Graham:

"Let's start with a test: Do you have any opinions that you would be reluctant to express in front of a group of your peers?

If the answer is no, you might want to stop and think about that. If everything you believe is something you're supposed to believe, could that possibly be a coincidence?

Odds are it isn't. Odds are you just think whatever you're told."

That's it. Thanks for reading. Please share which input you found the most helpful or intriguing. Just reply to this email with a number—it's quick and easy!

And as always, feel free to send me any interesting ideas you came across recently!

Looking forward to learning from you.

Cheers,

Cheng-Wei